Banking is a pain in the arse.

There, I said it.

Nothing seems simple with banks. Despite online banking, there is actually very little you can truly do exclusively online. Half the time you still need to go into a branch, bring various forms of ID and wait in line for aaaggeesss to get anything done.

Even trying to close my bank account recently, before we headed off on our full-time travel adventure, seemed nigh on impossible! And even then, I still had issues even after finally closing the account…

Anyway, that’s a story for another time.

When travelling, regular banks are expensive and cumbersome. The exchange rates are awful. The fees charged are ridiculous. And, if you forget to let your bank know that you’ll be abroad, they might even block your card leaving you stranded.

Luckily, there’s an alternative.

Drumroll please….

Revolut!

Revolut is… Well… Revolutionary 😅

Ok sorry, that’s pretty bad. But, Revolut is pretty awesome.

My husband and I have been using Revolut for a few months now, both at home in Ireland and on the road.

And, long story short, it quite simply an AMAZING travel card!

PS – This post may contain affiliate links: That means that if you purchase through my link, I will receive a small commission at no additional cost to you. Of course, I only recommend products/services that I have used and believe are great! Please read my disclosure for more info.

What Is Revolut?

Revolut is not a bank. Not in the traditional sense.

They call themselves an electronic money institution. It’s your financial partner. And the perfect travel card!

Simply put, Revolut is better than a bank!

It launched back in 2015 and is already used by over 7 million people around the world!

Yep! Time for you to catch up!

With Revolut, you’ll get a contactless debit card (Visa or Mastercard, depending on your location), and a really user-friendly app.

But best of all, you’ll get massive savings on fees when spending, withdrawing, and sending money abroad.

Revolut is available to customers around the world. As long as you are 18 years of age or older, and normally reside (are a legal resident) in the EEA (including Switzerland), Australia, Canada, the United States, and Singapore, Revolut is for you!

How Does Revolut Work?

Your contactless Revolut travel card works just like a regular debit card.

Without the fees.

And without the hassle of a bank.

Banks will charge you when you spend, withdraw or transfer money abroad. Usually with pretty steep fees.

With your Revolut travel card, there are no hidden fees. And yet they give you awesome exchange rates!

You can easily top up your Revolut account from your regular bank account either through online banking or by making a ‘payment’ with your bank card. Once you have money on your account, you can go ahead and spend and withdraw money with your Revolut travel card in over 140 countries around the world for free!

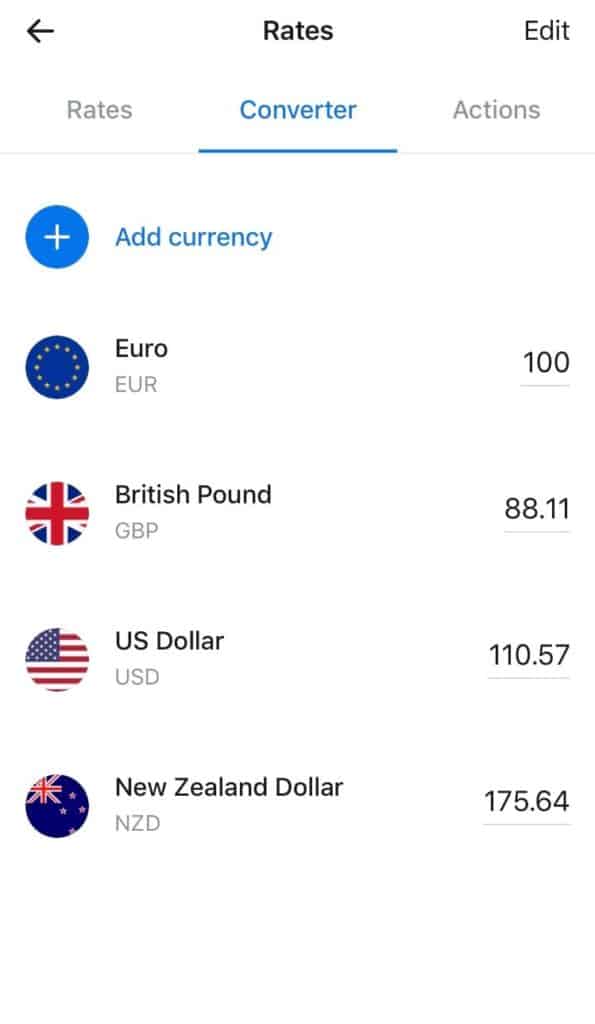

You can choose to set up “accounts” (kind of like wallets) with up to 29 different currencies. Basically, this means that you can transfer (up to €6000 a month) between currencies within your app at any time.

Or, if you’d rather not have to worry about keeping track of different wallets, you can simply spend and withdraw money and have it come straight out of your “main” account, whether that be in Euro, Pounds, Dollars, or whatever.

All you’ll be charged is the live foreign exchange rate at that exact moment (up to a set limit).

Why Do You Like This Travel Card So Much?

Oh boy, where do I even start?

The absolute best thing, and the reason our Revolut travel cards have saved us so much money already is that the exchange rate offered by Revolut matches the live market exchange rates.

If I compare the foreign exchange rate I’ve been given (both on purchases and ATM withdrawals) by Revolut, it always more or less matches the live rate I can see on xe.com.

This is huge!

And, the fact that there is no charge for withdrawing money with your Revolut travel card from international ATMs, means we’re not under any pressure to withdraw large lump sums. This both saves us the withdrawal fee our regular bank would charge (about €7 per withdrawal), plus gives us the peace of mind that we’re not walking around with wads of cash!

As well as that, the App is really clear, and super easy to use.

It even has some analytics to help you understand your spending habits, if you’re into that. You can see your spending by category, merchant and country.

Also, if your friends have Revolut too, you can easily and quickly (instantly, really!) transfer money between you. The “Split the Bill” function is awesome, and allows one of you to pay the full bill and then split it between your group evenly. Perfect for a night out!

You can even set a budget for various categories to help you control where you’re spending money.

See, it’s actually not just awesome as a travel card. It’s really great at home too.

What Are The Benefits Of A Revolut Account?

Ok, so let’s sum up the main benefits! Your free Revolut account allows you to;

- Spend, transfer and exchange money without fees in over 140 currencies (both in-store and online)

- This is free up to a limit of £5000 / €6000 / $6500 per (rolling) month

- A 0.5% fee applies once you hit this limit

- Withdraw the equivalent of €200 / £200 / $300 per (rolling) month for free from international ATMs that support Visa or Mastercard

- A 2% charge applies thereafter

- Have ‘accounts’ within your App allowing you to hold, transfer and exchange money in 29 different currencies

- Freeze and unlock your card yourself in the App if you’re worried that your card has been compromised

- Change your card pin number anytime within the App

- Set up smart savings, meaning Revolut will round up the amounts you actually spend and store the difference as savings

- Transfer regular currency to crypto currencies like Bitcoin and Litecoin

- Apply for a personal loan of up to £25,000 (UK residents only)

- Set up direct debits (in Euro only)

- Use Apple Pay and Google Pay (select countries only)

Top Tips:

- Look out for any fees that are applied by some ATM operators!

- If you get a choice at the ATM, opt to be charged in the local currency (i.e. “without conversion”) Otherwise, the ATM provider can apply their own exchange rates, which are not the lower interbank rates!

Note:

- All of this refers to the free Standard plan! This is the plan we have which has worked perfectly for us so far

- There are two paid plans available -> Premium and Metal. These have a monthly fee which then gives you additional benefits. However, we’ve not (yet) had a reason to upgrade, and so I can’t speak to these in any detail. Feel free to check out the details of the various price plans to see what might work best for you!

How Do I Get Started?

You can open an app-based Revolut account in minutes. It really is that fast, and it’s super simple!

Best of all, you can do it from the comfort of your own home (or on the road!) and there is no paperwork involved!

When you head over to the Revolut website, you’ll put in your mobile phone number and click “accept invite” (this will save you some money – more on this later! Keep reading!)

Revolut will then send you a link to the number you provided, where you can download the App.

Everything is done through the App!

Next, you’ll create a passcode that you’ll use going forward to log into your Revolut account.

Revolut will send you a 6 digit code to the phone number you provided, to verify that it’s really you. Enter some personal details like your name, date of birth, address and email, and just like that, your account will be created!

To fully activate your account, you’ll need to top up by €10, but you can skip that step at first if you’d like to get a feel for your new account before fully committing.

Finally, you’ll verify your identity.

This includes submitting a form of ID to prove that you live where you say you do.

Depending on which country you live in, the options might change but normally include your passport, drivers licence or national identity card. You’ll take pictures within the App of your ID, and then take a selfie! This allows Revolut to ensure you are the same person as the ID you’ve submitted.

Revolut reviews your documents within 10 minutes! In my experience it took much less than that though, and you’ll be verified and ready to go before you know it.

You Said Something About Saving Money??

That’s right! If you sign up through my link, you’ll save €5.99 / £4.99 / $4.99!

You see, normally there’s a fee for sending out your physical debit travel card.

But, you’re in luck my friend!

Since you’re here, I’m giving you your physical Revolut card absolutely free! No postage fees for you!

You’re welcome 😇

But, if you’re in a hurry (it can take up to 9 business days to deliver your physical card), you can still start spending and moving money straight away. Your Revolut account automatically allows you to get a virtual card too (well, up to five virtual cards, actually!)

The virtual card is great for making sure you stay safe when spending money online.

Plus, it means you’ll never lose your card!

Any Downsides?

A couple of times, we have experienced that transactions show up twice on our App, or money has been frozen even when a transaction failed.

However, these errors are normally rectified quickly and without hassle, usually automatically and without the need to contact Revolut’s in-App support chat function (which is pretty awesome too, by the way). Sure, it’s a bit of a hassle but it doesn’t happen often and so far, we’ve had no ongoing issues.

Some other potential downsides to Revolut to keep in mind;

- Your Revolut account doesn’t offer any interest rate on your savings

- Joint accounts aren’t possible – Individual accounts only

- Actually, this can work in your favour. Honestly the €200 withdrawal limit per month is a bit of a downside too, but if you and your partner both have your own Revolut account, you’ll have €400 at your disposal each month!

- There is no overdraft functionality

- SWIFT transfers may incur international wire transfer fees

- If you exchange across currencies on the weekend, you pay between 0.5% – 2% (depending on the currency) because the foreign exchange market is closed. So, save it for weekdays!

- If you need a replacement card, there is a €5 / £4.99 / $5 charge on top of the delivery fee

Conclusion

If you do any kind of international travel Revolut is without a doubt going to save you money.

The automatic money conversions at live interbank exchange rates means that spending and withdrawing money abroad with your Revolut travel card is super fast and easy, without having to worry about transaction fees or poor exchange rates.

Either way, it’s your choice, but I suggest that you at least give Revolut a try.

After all, if you sign up through my referral link, it won’t cost you a cent!

Nothing to lose, right?!

Related Posts You Might Like

20 Realistic Ways To Save Money For Travel

12 Essential Travel Items You Absolutely HAVE To Have For Your Next Trip!

Six Smart Ways To Spend Less While Travelling

15 Sneaky Travel Costs That Could Accidentally Blow Your Travel Budget